Why Nearshoring in Hungary Makes Business Sense – REFU Hungary

Nearshoring and contract manufacturing are now core strategies across European industry.

For German companies, Hungary combines significant cost savings with uncompromising quality —

particularly for electromechanical products such as inverters, energy storage systems (battery modules),

industrial automation equipment and electromechanical assemblies.

What is nearshoring — and why does it matter now?

Nearshoring means relocating manufacturing or service processes to a country that is geographically and culturally

close to the client company. In recent years, supply-chain disruptions, rising freight costs, geopolitical risks and sustainability requirements have all increased the value of manufacturing closer to the market.

While low-cost production in the Far East once dominated, today faster response times, flexible logistics and transparent quality assurance are decisive for German and Western-European firms. As a result, Central and Eastern Europe — especially Hungary — has become a strategic hub for manufacturing relocation.

Why move your production to Hungary?

- Direct cost advantage: materially lower labour and operating costs than in Germany.

- No quality trade-off: ISO / IATF certified quality systems, engineering support, audited processes.

- Strategic location: 19 countries within 1,000 km, next-day delivery to Germany in many lanes.

- Shorter supply chains: less working capital tied up in inventory, lower risk, faster reaction time.

Labour costs, logistics, facility rents — the tangible nearshoring advantages

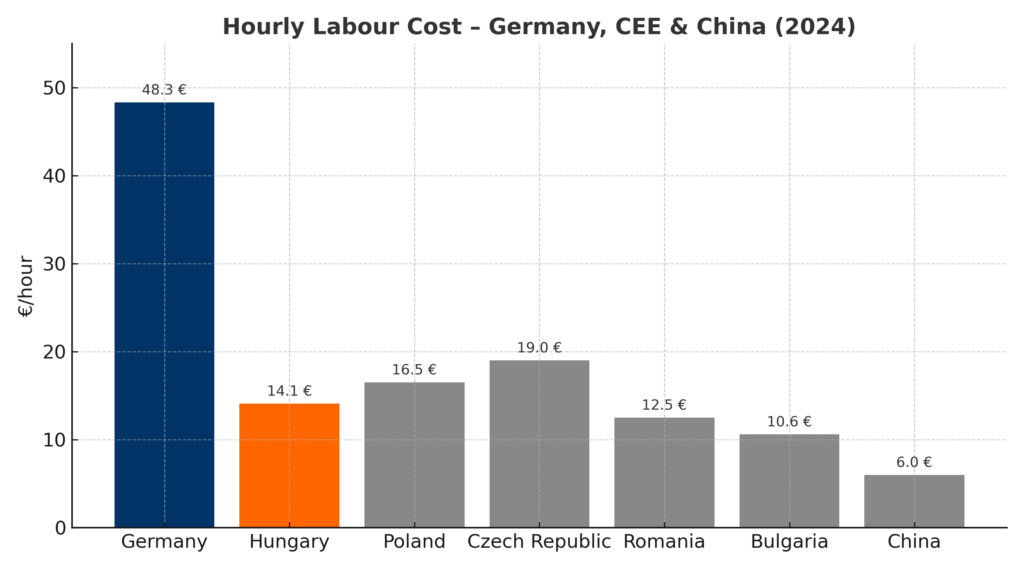

1) Labour cost — Germany, CEE and China (€/hour)

Sources: Eurostat, Destatis (2024). China: industry average ~€6/hour (indicative, based on sector summaries).

What this means for your manufacturing strategy

- The labour-cost component immediately reduces unit cost — especially in labour-intensive assemblies.

- Hungary’s wage level creates price or margin headroom: either more aggressive sales pricing or higher contribution margin.

- China’s hourly rate is lower, but total landed cost (lead time, inventory, QA, coordination) often outweighs wage savings — the full picture favours nearshoring.

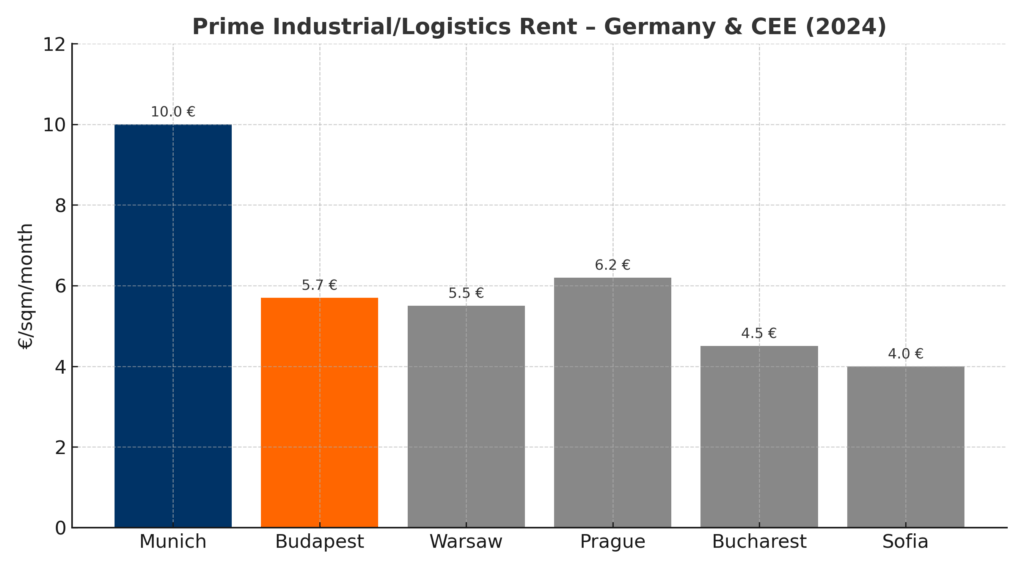

2) Prime industrial/logistics rent (€/m²/month) — Munich, Budapest and CEE

What this means for your facilities footprint

- Lower fixed-cost base → better TCO (Total Cost of Ownership) and lower break-even volumes.

- More flexibility: easier to scale or reconfigure space without rent inflation.

- Operational overhead (security, maintenance, facility services) is typically lower — rent is only part of the savings.

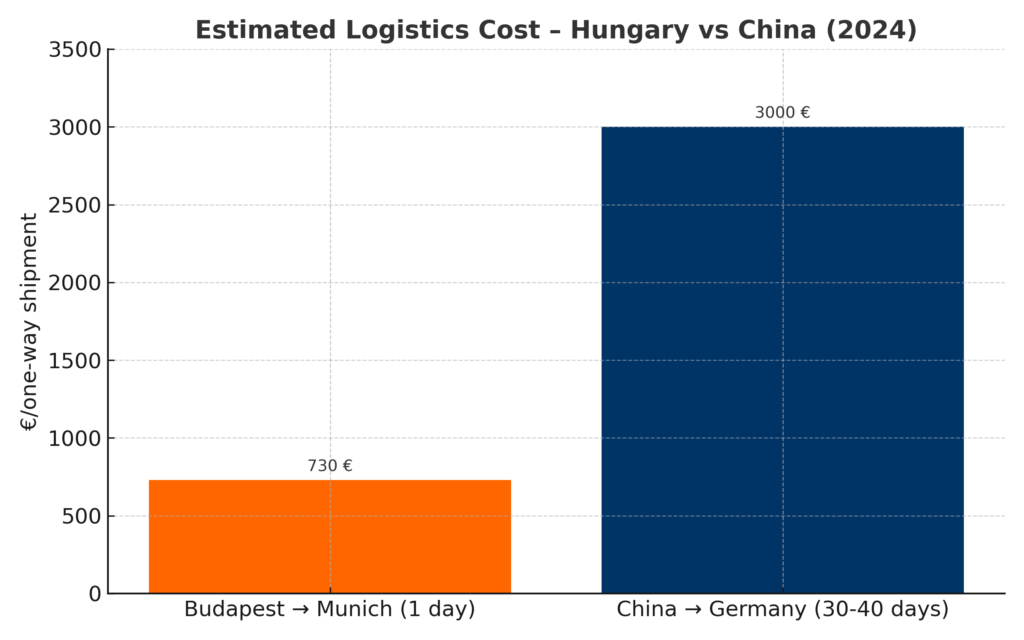

3) Logistics cost and time — Hungary vs China

China→Germany: ocean freight 30–40 days; higher total landed cost and working-capital tie-up.

Sources: EU/IRU freight benchmarks and freight forwarder publications (2024).

What this means for speed & working capital

- Cash-to-cash cycle shortens: less inventory, lower capital tied up, faster revenue realization.

- Greater agility: quicker engineering changes (ECNs) and tighter feedback loops with production.

- Lower supply-risk exposure (delays, trade frictions), better SLA performance.

Labour cost: immediate impact on unit economics

In labour-intensive assembly, Hungary’s hourly rates create a direct impact on the P&L.

For electromechanical products (e.g., inverters, control cabinets, battery modules) the labour share is substantial —

lower hourly rates reduce unit cost without any quality compromise.

Operating cost: rents and facility services

Prime industrial rents in Budapest are typically around half of Munich.

Combined with lower facility services and maintenance, the result is a more attractive operating TCO.

Logistics & time-to-market: closer to your customers

From Hungary, the German market is reachable in as little as one day with tariff-free EU shipping.In contrast, Far-East ocean freight takes 30–40 days and requires more working capital for inventory.

Nearshoring is therefore not only cheaper — it’s more agile with lower supply-chain risk.

Quality & competence: German standards at Hungarian cost levels

Major German manufacturers (e.g., Bosch, Continental, Audi, Mercedes-Benz) have operated in Hungary for decades,

building a stable quality culture and a deep supplier ecosystem. Standardised (ISO, IATF) processes, strong engineering support and continuous improvement ensure that

“Made in Hungary” quality is on par with Western-European benchmarks.

How REFU Hungary supports your nearshoring

As part of the PRETTL Group, REFU Hungary provides turnkey contract manufacturing for electromechanical products —

from prototyping to scalable serial production.

- Complex electromechanical manufacturing: inverters, energy-storage modules, industrial automation units, machinery assemblies and EV chargers.

- Scalable capacity: small and mid-size series, fast ramp-ups for new products.

- Quality management: ISO 9001, ISO 14001; measurable, auditable processes.

- Digital transparency: production tracking and traceability (real-time reporting, EU data handling).

- Supply-chain synergies: PRETTL group sourcing, regional suppliers, optimised TCO.

- Fast logistics: central CEE location — many German destinations in one day.

Let’s talk nearshoring — book a consultation

Book a 30-minute discovery call: cost breakdown, manufacturability, ramp-up timing.

Summary

Hungary offers a financial, quality and logistics advantage for German manufacturers.

With REFU Hungary, your nearshoring can launch quickly and in a controlled way — without compromises.

Learn more about our services on the REFU Hungary website.

Sources

- Eurostat — Hourly labour costs (2024); Destatis — Labour cost (DE, 2024)

- CBRE — Industrial/Logistics Market Snapshots (Budapest, Germany, 2024)

- IRU / EU freight benchmarks — 2024; freight-forwarder publications

- DHL / transit-time guides (EU–Asia, typical 30–40 day ocean lead time)